What's New Here?

EUR/USD Daily Outlook

EUR/USD Daily Outlook

Posted by Unknown | at 12:02 AM

|

| EURUSD Daily outlook by Tunde Popoola |

USD/CAD Daily Outlook- May 31, 2013

USD/CAD Daily Outlook- May 31, 2013

Posted by Unknown | at 2:47 PM

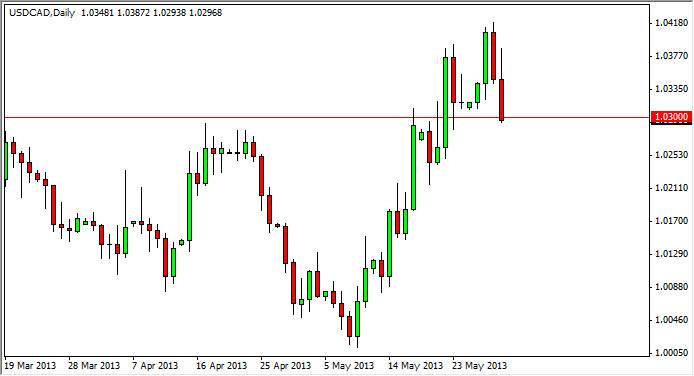

The

USD/CAD pair tried to rally during the session on Thursday, but as you

can see it turned around completely and broke through the 1.03 level in

order to test the support that could be the catalyst for this market to

head higher. This market has a significant amount of support below, but

the 1.02 level below is what the market will have to show me in order to

start selling as I think the next 100 pips or so should be that

supportive.

As far as the upside is concerned, I think that the 1.04 level is the major hurdle that we have to get over, and as a result I think that a bounce will certainly struggle at that point. However, the market has been very coming to the US dollar lately, and as a result we could see a nice bounce from this point in time. I think that this market could go as high as 1.10 overall, but needless to say won't necessarily be a straight journey up to that level. Of course, is possible that we break down below the 1.02 level, and this of course could see the market head towards the parity level.

If we did get below the parity level, this pair could fall apart but I really don't believe this is going to happen. I think that we will go higher, it's only a matter of time before we see the support needed.

As far as the upside is concerned, I think that the 1.04 level is the major hurdle that we have to get over, and as a result I think that a bounce will certainly struggle at that point. However, the market has been very coming to the US dollar lately, and as a result we could see a nice bounce from this point in time. I think that this market could go as high as 1.10 overall, but needless to say won't necessarily be a straight journey up to that level. Of course, is possible that we break down below the 1.02 level, and this of course could see the market head towards the parity level.

Watch the oil markets

Below markets will be a great influence on this market, and as a result I think the you would have to watch the WTI market in order to grasp what the USD/CAD pair could do. This market will be choppy regardless of which direction we go, but if you are willing to deal with the volatility, I believe that this pair could see longer-term moves come into the marketplace soon. It has a long history of choppy around and then suddenly moving in one direction rather violently, and this type of marketplace that we have seen around the world is certainly conducive for that type of move.If we did get below the parity level, this pair could fall apart but I really don't believe this is going to happen. I think that we will go higher, it's only a matter of time before we see the support needed.

Price Action Setups to Not Be Sucked Into

Price Action Setups to Not Be Sucked Into

Posted by Unknown | at 6:00 AM

A lot of traders understand that price

action trading is the art of looking at raw chart of a Forex pair, stock

or instrument and using only the raw price data to decipher order flow

from which they can spot high probability patterns that repeat

themselves time again in the markets.

By learning these patterns and order flow clues traders can position themselves in the correct way to profit from the next move in price.

Whilst many people cover the best setups and patterns to look for, what can at times be even more helpful is knowing what patterns to avoid or when the order flow signals given through the price action are sucking the trader in! A common term to explain traders being sucked into trading is “the false break”. Whilst trading the false break can be a super high probability trade for the price action trader that is doing the sucking in, the trader being sucked in can be in for pain.

In this article we are going to look at two really common sucker trades that traders need to avoid. These apply to not only price action trading but many other types of technical analysis trading.

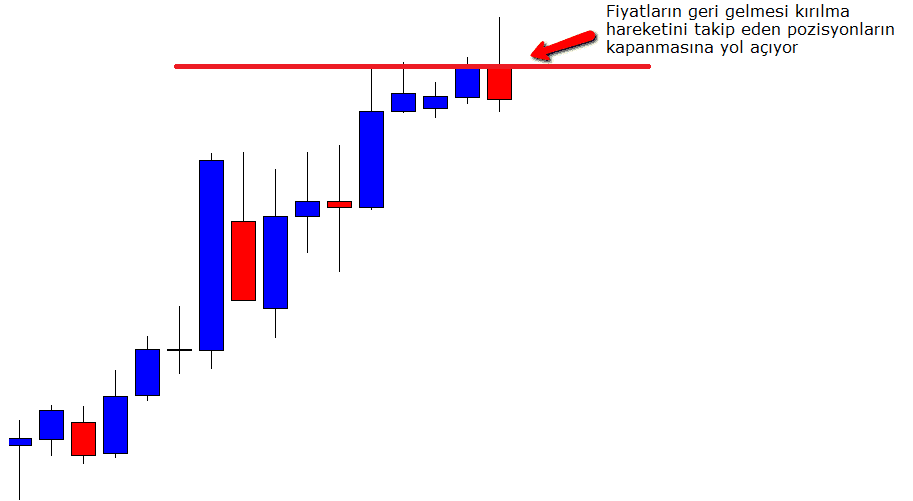

The False Break

The false break is a pattern that can be very profitable for the trader who is patient, but for the trader who jumps the gun or doesn’t wait for confirmation it can be a sucker trade. The false break is easy to spot and is basically noted by price moving through a level before snapping back the other way.

The false break moves often happen at key levels of support or resistance. The traders who enter when price is breaking out can be sucked in and then stopped out as price whips back the other way. For the trader who is patient they can watch price snapping back and use it to trade in the opposite direction to the break out.

Below I have attached two charts. The first chart shows price starting to break out higher through resistance. Upon noticing this, the break out traders would start to take long trades.

The second chart shows price snapping back lower which would stop the break out trader. This is also when the trader who has been patient could use this false break signal to take a short trade and use the false break in their favour, rather than being sucked in like the break out trader.

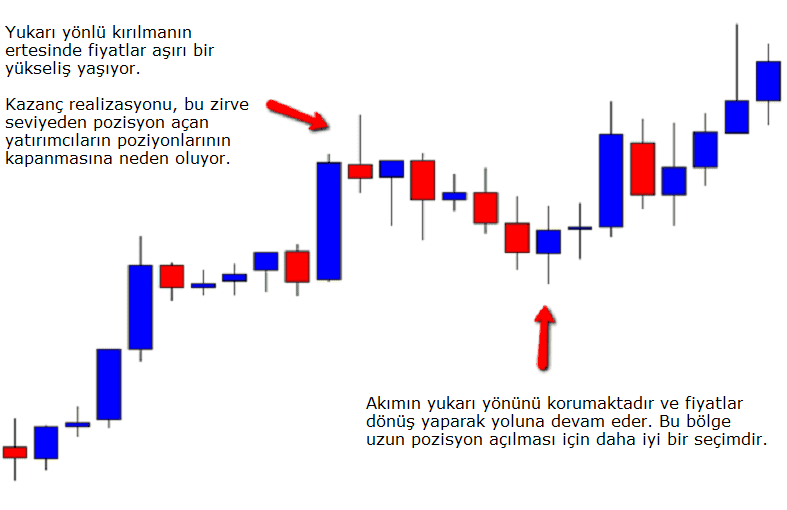

Entering From Extreme Highs and Lows

When traders come to Forex they have a strong urge to trade from the extreme highs and lows. The main reason for this is these new traders hear the saying “The trend is your friend” and they try to implement it into their trading. Because they normally lack a solid education, the new trader does not understand how to enter high probability trades with the trend.

The risk of entering trades after the market has made a large move is that the people who have made money from the large move will begin to take profit. This can lead to the market turning back the other way. As the new trader starts entering the market at the extreme high or low, the professionals are taking profit and leaving the market which will cause price to change directions against the new trader’s positions.

The chart below highlights how this pattern works and how it leads many traders to being sucked in. On the chart you can see price has made a large move higher. From this move higher a lot of traders would have made solid profits. The high of this market is where a lot of traders will enter trying to trade with the trend. As we said above the worry is that the traders who are holding profit can take profit at this high which will cause price to move lower and stop the new trader out.

The best way to enter high probability trades with the trend is to wait for price to rotate off the extreme high or low back into a value area. Tutorials on how to trade these price action signals with and against the trend can be found in my earlier articles.

By learning these patterns and order flow clues traders can position themselves in the correct way to profit from the next move in price.

Whilst many people cover the best setups and patterns to look for, what can at times be even more helpful is knowing what patterns to avoid or when the order flow signals given through the price action are sucking the trader in! A common term to explain traders being sucked into trading is “the false break”. Whilst trading the false break can be a super high probability trade for the price action trader that is doing the sucking in, the trader being sucked in can be in for pain.

In this article we are going to look at two really common sucker trades that traders need to avoid. These apply to not only price action trading but many other types of technical analysis trading.

The False Break

The false break is a pattern that can be very profitable for the trader who is patient, but for the trader who jumps the gun or doesn’t wait for confirmation it can be a sucker trade. The false break is easy to spot and is basically noted by price moving through a level before snapping back the other way.

The false break moves often happen at key levels of support or resistance. The traders who enter when price is breaking out can be sucked in and then stopped out as price whips back the other way. For the trader who is patient they can watch price snapping back and use it to trade in the opposite direction to the break out.

Below I have attached two charts. The first chart shows price starting to break out higher through resistance. Upon noticing this, the break out traders would start to take long trades.

The second chart shows price snapping back lower which would stop the break out trader. This is also when the trader who has been patient could use this false break signal to take a short trade and use the false break in their favour, rather than being sucked in like the break out trader.

Entering From Extreme Highs and Lows

When traders come to Forex they have a strong urge to trade from the extreme highs and lows. The main reason for this is these new traders hear the saying “The trend is your friend” and they try to implement it into their trading. Because they normally lack a solid education, the new trader does not understand how to enter high probability trades with the trend.

The risk of entering trades after the market has made a large move is that the people who have made money from the large move will begin to take profit. This can lead to the market turning back the other way. As the new trader starts entering the market at the extreme high or low, the professionals are taking profit and leaving the market which will cause price to change directions against the new trader’s positions.

The chart below highlights how this pattern works and how it leads many traders to being sucked in. On the chart you can see price has made a large move higher. From this move higher a lot of traders would have made solid profits. The high of this market is where a lot of traders will enter trying to trade with the trend. As we said above the worry is that the traders who are holding profit can take profit at this high which will cause price to move lower and stop the new trader out.

The best way to enter high probability trades with the trend is to wait for price to rotate off the extreme high or low back into a value area. Tutorials on how to trade these price action signals with and against the trend can be found in my earlier articles.

10 Price Action Tips That Will Make You a Better Swing Trader

10 Price Action Tips That Will Make You a Better Swing Trader

Posted by Unknown | at 5:16 AM

What is price action?

Price action for swing traders is the art of looking at individual candles to determine the probable direction of a stock - without using any technical indicators.

Ultimately, analyzing price action tells you who is in control of a stock. It also tells you who is losing control: the buyers or the sellers. Once you are able to determine this, you can pinpoint reversals in a stock and make money.

Learn the price action tips on this page and I guarantee you that you will be a better swing trader.

Let's begin.

Some traders think that a support or resistance level is a specific price. Wrong. It's an area on a stock chart. Let me give you an example.

The areas that I have highlighted are the correct support and

resistance levels. Often times you will hear traders say something like

this: "The support level for XYZ stock is $28.76." This is wrong.

It's an area - not a specific price.

The areas that I have highlighted are the correct support and

resistance levels. Often times you will hear traders say something like

this: "The support level for XYZ stock is $28.76." This is wrong.

It's an area - not a specific price.

Look at the area that I have highlighted in green. You may have

considered buying this pullback. Now look at the prior swing point high

(yellow highlighted). There are two problems with buying this

pullback. First, there isn't much room to work with! The distance

between the pullback and the prior high is too small. You need more

room to run so that you can at least get your stop to break even.

Look at the area that I have highlighted in green. You may have

considered buying this pullback. Now look at the prior swing point high

(yellow highlighted). There are two problems with buying this

pullback. First, there isn't much room to work with! The distance

between the pullback and the prior high is too small. You need more

room to run so that you can at least get your stop to break even.

The second problem is this: The prior high (yellow area) is composed of a cluster of candles. This is a strong resistance area! So, it will be very difficult for a stock to break through this area. Instead, look to trade pullbacks where the prior high is only composed of one or two candles.

This stock was moving lower in October (highlighted) and then

suddenly it dropped more significantly than on previous days. This

created the wide range candle and it marked an important turning point

(actually the bottom!).

This stock was moving lower in October (highlighted) and then

suddenly it dropped more significantly than on previous days. This

created the wide range candle and it marked an important turning point

(actually the bottom!).

You can also use wide range candles to identify when a stock might reverse. Looking at the same chart...

This stock reversed inside of prior wide range candles. Why would a

stock do this? Because all of the traders that missed out on "the big

move" now have a second chance to get in. This buying pressure causes

the reversal. Simple, huh?

This stock reversed inside of prior wide range candles. Why would a

stock do this? Because all of the traders that missed out on "the big

move" now have a second chance to get in. This buying pressure causes

the reversal. Simple, huh?

Narrow range candles tell you that the previous momentum has slowed

down. Buyers and sellers are in equilibrium but eventually one of them

will take control of the stock!

Narrow range candles tell you that the previous momentum has slowed

down. Buyers and sellers are in equilibrium but eventually one of them

will take control of the stock!

Imagine what this hammer candle looked like during the day (before it

became a hammer). It was really bearish! But, at some point during

the day, the bulls rejected the lower price level. I can imagine the

bulls saying, "Hey wait a just a second. You bears have taken this too

far. This stock is worth much more than the price that you moved it

to."

Imagine what this hammer candle looked like during the day (before it

became a hammer). It was really bearish! But, at some point during

the day, the bulls rejected the lower price level. I can imagine the

bulls saying, "Hey wait a just a second. You bears have taken this too

far. This stock is worth much more than the price that you moved it

to."

And the buying begins.

Here is an example:

All of the important reversals in this stock happened only after a candle moved at least 50% into the prior days range (some moved much more than 50%).

All of the important reversals in this stock happened only after a candle moved at least 50% into the prior days range (some moved much more than 50%).

This concept is so powerful that I am suspicious of buying any pullback unless it moves at least 50% into the prior days range.

You can probably see what is happening here. The stock gaps down at

the open. Everyone thinks this stock is going to tank. But it doesn't!

Buyers come in and move this stock right back up. You can look at one

of these candles and almost see all of the confused faces on other

stock traders!

You can probably see what is happening here. The stock gaps down at

the open. Everyone thinks this stock is going to tank. But it doesn't!

Buyers come in and move this stock right back up. You can look at one

of these candles and almost see all of the confused faces on other

stock traders!

The price action moved about halfway down (arrow) into the prior

swing (dotted line). This is good. If it retraced more than that, you

may want to question the validity of the move. This is because a stock

in a strong trend should not retrace more than halfway into a prior

swing. It should encounter buying pressure sooner than the half way

mark. And many times stocks will reverse right at the halfway mark.

The price action moved about halfway down (arrow) into the prior

swing (dotted line). This is good. If it retraced more than that, you

may want to question the validity of the move. This is because a stock

in a strong trend should not retrace more than halfway into a prior

swing. It should encounter buying pressure sooner than the half way

mark. And many times stocks will reverse right at the halfway mark.

You should always look to short a stock after consecutive up days. And, you should look to buy a stock

after consecutive down days. This is counter intuitive for new traders

because they tend to associate a stock going down as "bad" (meaning

sell) and a stock going up as "good" (meaning buy). In fact, it is just

the opposite!

You should always look to short a stock after consecutive up days. And, you should look to buy a stock

after consecutive down days. This is counter intuitive for new traders

because they tend to associate a stock going down as "bad" (meaning

sell) and a stock going up as "good" (meaning buy). In fact, it is just

the opposite!

This stock broke out (horizontal line) from a double bottom

(circled). A new trend has begun. So, you want to buy this stock on

the first pullback (arrow) after the breakout.

This stock broke out (horizontal line) from a double bottom

(circled). A new trend has begun. So, you want to buy this stock on

the first pullback (arrow) after the breakout.

So, there you have it. These price action tips and tricks will make you money in the stock market.

You can use this information to make your own trading strategies and systems. Best of all, once you master this art, you will never have to rely on technical indicators again to make trading decisions.

They won't be necessary.

Price action for swing traders is the art of looking at individual candles to determine the probable direction of a stock - without using any technical indicators.

Ultimately, analyzing price action tells you who is in control of a stock. It also tells you who is losing control: the buyers or the sellers. Once you are able to determine this, you can pinpoint reversals in a stock and make money.

Learn the price action tips on this page and I guarantee you that you will be a better swing trader.

Let's begin.

Tip #1. Identify support and resistance levels

This is a no brainer. Identifying support and resistance levels is one of the first things you learn in technical analysis. It is the most important aspect of chart reading. But, how many traders really pay attention to it? Not many. Most are too busy looking at Stochastics, MACD, and other nonsense.Some traders think that a support or resistance level is a specific price. Wrong. It's an area on a stock chart. Let me give you an example.

The areas that I have highlighted are the correct support and

resistance levels. Often times you will hear traders say something like

this: "The support level for XYZ stock is $28.76." This is wrong.

It's an area - not a specific price.

The areas that I have highlighted are the correct support and

resistance levels. Often times you will hear traders say something like

this: "The support level for XYZ stock is $28.76." This is wrong.

It's an area - not a specific price.Tip #2. Analyze swing points

Swing points (some call them "pivot points") are those areas on a stock chart where important short term reversals take place. But not all swing points are created equal. If fact, your decision to buy a pullback will depend upon the prior swing point. Here is an example: Look at the area that I have highlighted in green. You may have

considered buying this pullback. Now look at the prior swing point high

(yellow highlighted). There are two problems with buying this

pullback. First, there isn't much room to work with! The distance

between the pullback and the prior high is too small. You need more

room to run so that you can at least get your stop to break even.

Look at the area that I have highlighted in green. You may have

considered buying this pullback. Now look at the prior swing point high

(yellow highlighted). There are two problems with buying this

pullback. First, there isn't much room to work with! The distance

between the pullback and the prior high is too small. You need more

room to run so that you can at least get your stop to break even.The second problem is this: The prior high (yellow area) is composed of a cluster of candles. This is a strong resistance area! So, it will be very difficult for a stock to break through this area. Instead, look to trade pullbacks where the prior high is only composed of one or two candles.

Tip #3. Look for wide range candles

Wide range candles mark important changes in sentiment on every chart - in every time frame. They mark important turning points and can often be used to identify reversals. Take a look at the following stock chart: This stock was moving lower in October (highlighted) and then

suddenly it dropped more significantly than on previous days. This

created the wide range candle and it marked an important turning point

(actually the bottom!).

This stock was moving lower in October (highlighted) and then

suddenly it dropped more significantly than on previous days. This

created the wide range candle and it marked an important turning point

(actually the bottom!).You can also use wide range candles to identify when a stock might reverse. Looking at the same chart...

This stock reversed inside of prior wide range candles. Why would a

stock do this? Because all of the traders that missed out on "the big

move" now have a second chance to get in. This buying pressure causes

the reversal. Simple, huh?

This stock reversed inside of prior wide range candles. Why would a

stock do this? Because all of the traders that missed out on "the big

move" now have a second chance to get in. This buying pressure causes

the reversal. Simple, huh?Tip #4. Narrow range candles lead to explosive moves

Narrow range candles can also tell you that a reversal is imminent. This low volatility environment can lead to explosive moves. Narrow range candles tell you that the previous momentum has slowed

down. Buyers and sellers are in equilibrium but eventually one of them

will take control of the stock!

Narrow range candles tell you that the previous momentum has slowed

down. Buyers and sellers are in equilibrium but eventually one of them

will take control of the stock!Tip #5. Find rejected price levels

On candlestick charts, lower or upper shadows on candles usually means that there is a hammer candlestick pattern or a shooting star candlestick pattern (if the shadow is long enough). Regardless of the name, these shadows mean one thing: A price level has been rejected. Imagine what this hammer candle looked like during the day (before it

became a hammer). It was really bearish! But, at some point during

the day, the bulls rejected the lower price level. I can imagine the

bulls saying, "Hey wait a just a second. You bears have taken this too

far. This stock is worth much more than the price that you moved it

to."

Imagine what this hammer candle looked like during the day (before it

became a hammer). It was really bearish! But, at some point during

the day, the bulls rejected the lower price level. I can imagine the

bulls saying, "Hey wait a just a second. You bears have taken this too

far. This stock is worth much more than the price that you moved it

to."And the buying begins.

Tip #6. Learn the 50% rule

How can you tell if a candle is significant? Easy. Look to see how far it has moved into the prior days range. If it moves at least 50% into the prior days range, then it is significant. And, it is especially significant if it closes at least 50% into the prior days range. This usually shows up on the stock chart as a piercing candlestick pattern or an engulfing candlestick pattern.Here is an example:

All of the important reversals in this stock happened only after a candle moved at least 50% into the prior days range (some moved much more than 50%).

All of the important reversals in this stock happened only after a candle moved at least 50% into the prior days range (some moved much more than 50%).This concept is so powerful that I am suspicious of buying any pullback unless it moves at least 50% into the prior days range.

Tip #7. The gap and trap price pattern

All gaps are important "tells" on any stock chart. But, there is one type of gap that is especially important when analyzing price action (and pinpointing reversals). This is called a gap and trap. This is a stock that gaps down at the open but then closes the day above the opening price. It is easier to see this on a chart... You can probably see what is happening here. The stock gaps down at

the open. Everyone thinks this stock is going to tank. But it doesn't!

Buyers come in and move this stock right back up. You can look at one

of these candles and almost see all of the confused faces on other

stock traders!

You can probably see what is happening here. The stock gaps down at

the open. Everyone thinks this stock is going to tank. But it doesn't!

Buyers come in and move this stock right back up. You can look at one

of these candles and almost see all of the confused faces on other

stock traders!Tip #8. Measure the depth of a swing

How far does a stock move into the prior swing? More than halfway or less? The answer to these questions are important because it can determine the future direction of the stock. Let me give you an example: The price action moved about halfway down (arrow) into the prior

swing (dotted line). This is good. If it retraced more than that, you

may want to question the validity of the move. This is because a stock

in a strong trend should not retrace more than halfway into a prior

swing. It should encounter buying pressure sooner than the half way

mark. And many times stocks will reverse right at the halfway mark.

The price action moved about halfway down (arrow) into the prior

swing (dotted line). This is good. If it retraced more than that, you

may want to question the validity of the move. This is because a stock

in a strong trend should not retrace more than halfway into a prior

swing. It should encounter buying pressure sooner than the half way

mark. And many times stocks will reverse right at the halfway mark.Tip #9. Consecutive up days and consecutive down days

Stocks will reverse direction after consecutive up days or down days. So, it pays to keep this in mind when you are looking to buy or short a stock. Here is an example: You should always look to short a stock after consecutive up days. And, you should look to buy a stock

after consecutive down days. This is counter intuitive for new traders

because they tend to associate a stock going down as "bad" (meaning

sell) and a stock going up as "good" (meaning buy). In fact, it is just

the opposite!

You should always look to short a stock after consecutive up days. And, you should look to buy a stock

after consecutive down days. This is counter intuitive for new traders

because they tend to associate a stock going down as "bad" (meaning

sell) and a stock going up as "good" (meaning buy). In fact, it is just

the opposite!Tip #10. Location of price in a trend

You have heard the saying, "The trend is your friend." I say, "The beginning of a trend is your friend!" That is because some of the best moves occur at the very beginning of a trend... This stock broke out (horizontal line) from a double bottom

(circled). A new trend has begun. So, you want to buy this stock on

the first pullback (arrow) after the breakout.

This stock broke out (horizontal line) from a double bottom

(circled). A new trend has begun. So, you want to buy this stock on

the first pullback (arrow) after the breakout.So, there you have it. These price action tips and tricks will make you money in the stock market.

You can use this information to make your own trading strategies and systems. Best of all, once you master this art, you will never have to rely on technical indicators again to make trading decisions.

They won't be necessary.

Subscribe to:

Posts (Atom)